us germany tax treaty summary

An affiliated group of US includible corporations consisting of a US parent and its US. Double taxation treaties are agreements between 2 states which are designed to.

German Tax Laws Pushed Through Before End Of Current Parliamentary Term Verena Klosterkemper

However the exceptions to the saving clause in some treaties allow a resident of the United States to claim a tax treaty exemption on US.

. The radio and TV tax in Germany is 1836 euros a month per household regardless of how many people live in it. A church tax is a voluntary tax collected by the state from members of some religious denominations to provide financial support of churches such as the salaries of its clergy and to pay the operating cost of the church. Certain treaties allow a US.

In this connection as an additional requirement the government of India has notified Form 10F wherein the person has to self-declare prescribed details. If Marks German tax liability on the 13500 is 1500 once converted from EUR the foreign tax credit of 200 will reduce his German liability to 1300. The United States is a party to tax treaties designed to prevent double taxation of the same income by the United States and the treaty country.

It is separate from and in addition to your foreign tax credit for foreign taxes paid or accrued on. It helps many people who without the agreement would not be eligible for monthly retirement disability or survivors benefits under the Social Security system of one or both countries. US persons making payments withholding agents to foreign persons generally must withhold 30 of payments such as dividends interest and royalties made to foreign persons.

It occurs when income is taxed at both the corporate and personal level or by two nations. Ireland and Kosovo signed a new DTA on 25 June 2021. The double tax treaty tells Mark that the UK has the main right to tax the income and that if Germany also wants to tax it then the foreign tax credit method should be used to avoid double tax.

Its provisions entered into effect on 1 January 2022. If the payor knows or has reason to know that an owner of income is not eligible for treaty benefits claimed the payor must not apply the treaty rate. Germany is a key member of the European economic political and defence organisations.

The majority of USUK. How Much Is The Radio Tax In Germany. Citizen an additional credit for part of the tax imposed by the treaty partner on US.

Residents of any country that is considering negotiating or renegotiating an income tax treaty with the United States should closely monitor the status of negotiations and analyze the availability of potential benefits under a treaty that incorporates the 2016 US Models provisions. Tax Residency Certificate TRC For the purpose of claiming a tax treaty benefit it is necessary for an NR to obtain a TRC of it being resident of the other country or specified territory. It gets collected per quarter so that you will pay 5508 euros four times a year.

Tax treaty for example would help alleviate this particular situation. Double taxation refers to income taxes paid twice on the same income source. A tax treaty is a bilateral two-party agreement made by two countries to resolve issues involving double taxation of passive and active income of each of their respective citizens.

The income code numbers shown in this table are the same as the income codes on Form 1042-S Foreign Persons US. To claim it youd file Form 8833 and include your situation in the summary. Article 24 of the USUK.

The Protocol to the existing DTA and Amending Protocol between Ireland and Germany entered into force on 30 December 2021. A church tax is collected in Austria Denmark Finland Germany Iceland Italy Sweden some parts of Switzerland and several other countries. Protect against the risk of double taxation where the same income is taxable in 2 states.

However the payor is not responsible for misstatements on a Form W-8. The German economy is. An agreement effective December 1 1979 between the United States and Germany improves Social Security protection for people who work or have worked in both countries.

The German capital gains tax is 25 plus Solidarity surcharge add-on tax initially introduced to finance the 5 eastern states of Germany Mecklenburg-Western Pomerania Saxony Saxony-Anhalt Thuringia and Brandenburg and the cost of the reunification but later kept to finance all kinds of public funded projects in all Germany plus Kirchensteuer church tax voluntarily. Summary of US tax treaty benefits. Income tax including the requirement that the income be remitted to your country of residence if that is a requirement under your treaty with the United States.

The price was increased last in August 2021. Under US domestic tax laws a foreign person generally is subject to 30 US tax on a gross basis on certain types of US-source income. Germany has the largest economy and is the second most populous nation after Russia in Europe.

You must meet all of the treaty requirements before the item of income can be exempt from US. Is It Mandatory To Pay ARD ZDF. Tax benefits you get from treaties dont have to be claimed with Form 8833.

The official language of Germany is German and the currency is the euro EUR. It is divided into 16 provinces and its capital is Berlin. The DTA is not yet.

Before you run out and file this form talk to a Tax Advisor. The following is a summary of the work underway to negotiate new DTAs and to update existing agreements.

Us Expat Taxes For Americans Living In Germany Bright Tax

Donald Trump Approves Plan To Pull 9 500 Troops From Germany News Dw 01 07 2020

The Inheritance And Gift Tax In Germany Reform Potentials For Tax Revenue Efficiency And Distribution Public Sector Economics

Pin By Claire Queenan On International Affairs In The 1920 S How To Plan Economy Germany

Germany Adopts Substantial Transfer Pricing And Anti Treaty Shopping Rule Changes Mne Tax

Fall Of Constantinople Facts Summary Significance Byzantine Empire Map Ottoman Empire Fall Of Constantinople

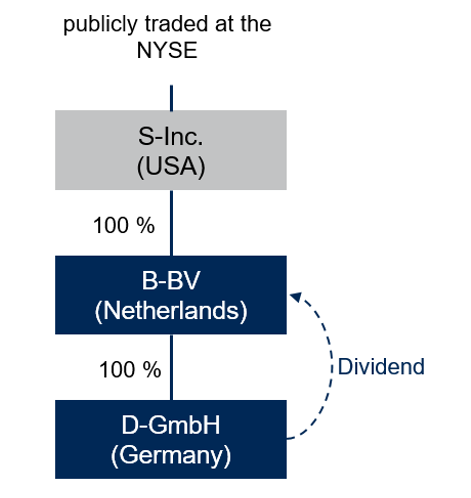

What Is The U S Germany Income Tax Treaty Becker International Law